CRA-TUBULARS

CRA-Tubulars: The Vanguard of Corrosion Resistance. A cutting-edge engineering firm with a rich legacy of excellence and innovation. We specialize in the energy sector and are committed to addressing challenges to well integrity, cost efficiency, and oil production optimization. Our groundbreaking technology, TCT, is on track for API-5C5 and 5CT certification, heralding a new era in corrosion resistance.

CRA-Tubulars: Revolutionizing Well-Integrity Solutions with TCT – Titanium lined Composite Tubulars

In the dynamic landscape of the energy sector, well-integrity challenges, cost constraints, and production losses are persistent hurdles. CRA-Tubulars is at the forefront of overcoming these challenges by introducing TCT – Titanium Composite Tubulars. This groundbreaking innovation combines titanium’s robustness, carbon fiber‘s agility, and aerospace epoxy‘s resilience to craft technically superior and economically viable downhole completion tubing and connections. Engineered to meet stringent oilfield standards, TCT ensures seamless qualification and implementation, setting a new benchmark in corrosion resistance and operational efficiency. Join us in embracing this transformative technology and redefine the future of well-integrity solutions.

Mission

- Delivering API 5-C5 and 5CT Certified Solutions for Extreme Downhole Challenges:

- In the demanding environments of Oil and Gas, CCS, and emerging energy sectors, CRA-Tubulars is committed to providing an full API 5 certified OCTG solution. Our technology is engineered to withstand the most challenging downhole conditions, ensuring reliability and performance.

- Introducing an Affordable Titanium-Carbon-Fiber-Epoxy OCTG Solution:

- We believe in innovation without compromise. Our OCTG solution, crafted from titanium, carbon fiber, and epoxy, offers superior commercial lifecycle performance. It’s not just a product; it’s a commitment to affordability and excellence.

- Leveraging Aerospace and Deep Water Technology for Downhole Applications:

- At CRA-Tubulars, we repurpose and leverage cutting-edge aerospace and deep-water technologies. By employing these advanced techniques for downhole field requirements, we patent and manufacture developments that build tangible company value. Innovation meets practicality in our approach.

- Building Lasting Partnerships for Accelerated Implementation:

- Collaboration is at the core of our mission. We strive to build lasting relationships with technical partners and customers, joining forces to accelerate both technical and commercial implementation. Together, we are more than a company; we are a community driving the future of energy solutions.

Goals

CRA-Tubulars: Pioneering High-Performance Corrosion Resistant OCTG Solutions

In the ever-evolving landscapes of Oil and Gas, CCS, and alternative energy applications, CRA-Tubulars aspires to be the beacon of innovation as a leading provider of high-performance corrosion-resistant OCTG solutions. Our mission transcends mere provision; we are committed to setting new industry standards.

Proving Superiority in Demanding Corrosive Well Environments:

Our ambition is fueled by the relentless pursuit of excellence. We intend to validate in the field that TCT (Titanium Composite Tubulars) is not just an alternative but a superior tubular solution designed to thrive in the most demanding corrosive well environments. It’s a promise of quality, backed by rigorous testing and real-world application.

Building Trust Through Expertise and Collaboration:

At CRA-Tubulars, we recognize that innovation is a collective endeavor. Our team’s profound expertise, personal reputation, and enduring relationships with customers, technology partners, and suppliers in the Energy industry form the bedrock of our approach. Supporting a step change in technology while ensuring robustness, we foster a level of trust that is vital for the successful adoption of new technology. Together, we are not just embracing change; we are shaping the future of energy solutions.

This version emphasizes the company’s commitment to innovation, quality, and collaboration. It speaks to the technical expertise of the target audience while also conveying a sense of vision and purpose that aligns with the broader goals of the energy industry.

Vision

Market Challenge

The annual cost of OCTG tubing in the Energy Industry is estimated to be $91 Billion. The premium alloy market equates to $3.4 Billion for corrosion-resistant tubing in annual capital expenditures related to corrosion.

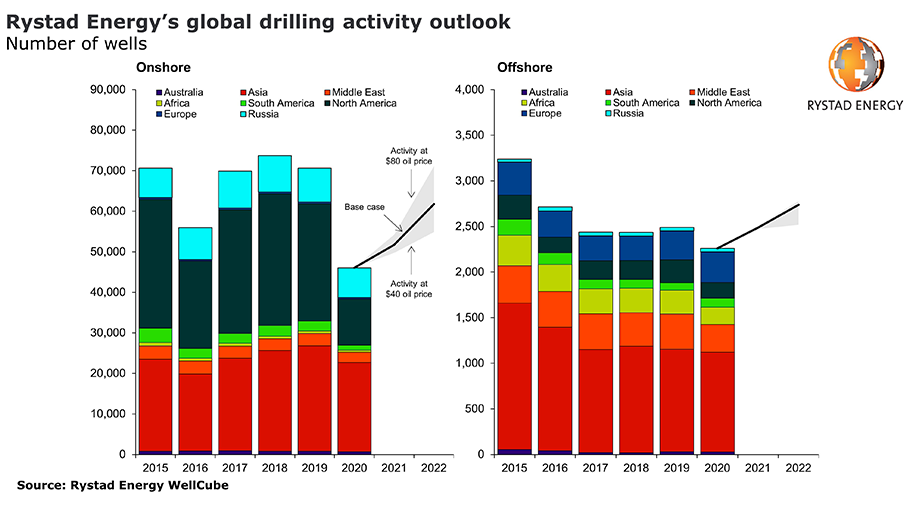

With around 1800 rigs operating in 2022, Rystad Energy expects around 54,000 wells to be drilled worldwide in 2021, a 12% increase from 2020. In 2022 drilling is set to increase even more, by another 19% year-on-year to about 64,500 wells, though activity will still fall short of the 73,000 wells drilled in 2019.

Navigating the Rising Costs and Risks in the Evolving Energy Landscape:

The energy sector stands at the threshold of unprecedented challenges and opportunities. Direct costs and HSE risks are poised to escalate in the coming years, driven by the demands of CCS and alternative energy applications that necessitate high-end alloy solutions. The exploration of deeper reservoirs, characterized by higher temperatures and pressures and enriched with greater concentrations of corrosive mediums, further compounds these challenges. Within the industry, it’s widely acknowledged that effective corrosion management is not merely a necessity but a strategic advantage, unlocking significant benefits.

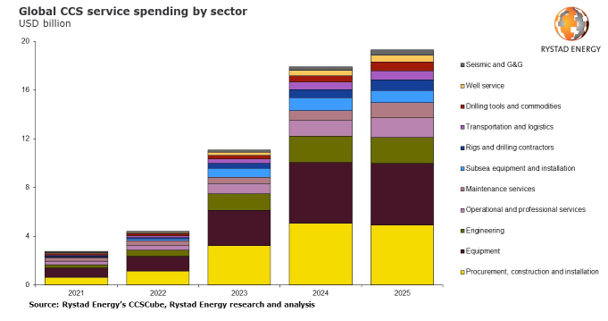

The Surge in Carbon Capture and Storage (CCUS) Investments:

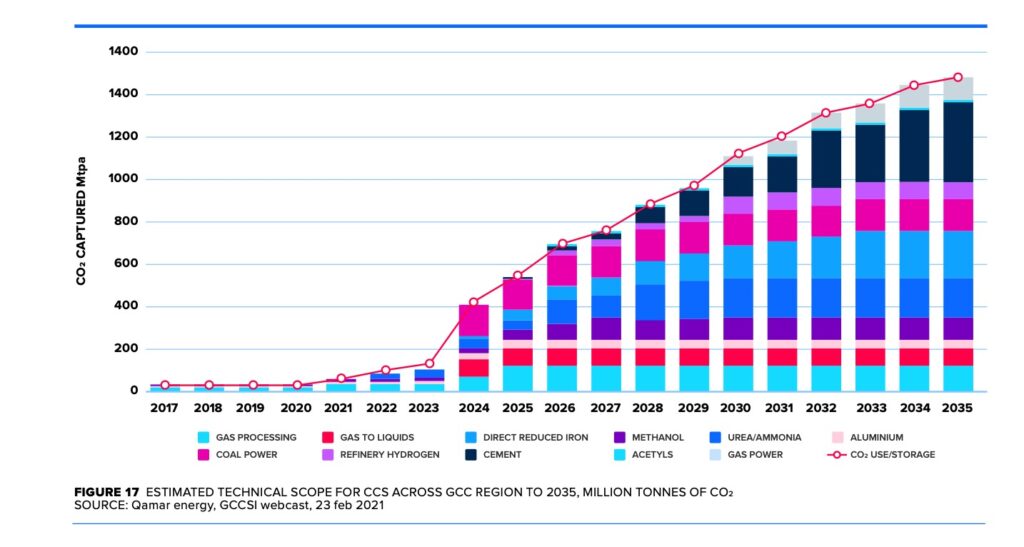

The momentum towards a sustainable future is palpable. Rystad Energy’s research paints a vivid picture of the burgeoning investments in the CCUS sector. Spending is projected to quadruple from 2022 to 2025, with cumulative global expenditure surpassing an astounding $50 billion over the next three years.

A Global Commitment to Reducing Carbon Footprint:

The world is rallying around the cause. With 56 commercial CCUS projects already operational, capable of capturing up to 41 million tonnes per annum (tpa) of CO2 across diverse industries, the commitment is clear and strong. The horizon looks even more promising, with nearly 140 CCUS plants potentially operational by 2025, capturing at least 150 million tpa of CO2. These projects, currently in various stages of development, including feasibility, concept, and construction, symbolize a global resolve to mitigate carbon emissions.

Shell GameChanger and CRA Tubulars: A Partnership for Innovation in CCUS and Hydrogen OCTG Applications:

In a landmark collaboration, Shell GameChanger is funding CRA Tubulars to advance their cutting-edge Titanium Composite Tubular technology. The goal is clear and ambitious: achieving API 5C5 certification for CCUS and Hydrogen OCTG applications. This partnership symbolizes a shared commitment to innovation and excellence in the energy sector.

The Revitalization of North Sea Brownfields:

A new era is dawning in the North Sea, with brownfields currently under meticulous planning. Major integrated projects like L10, Acorn, and Porthos are in the conceptual design phase, with significant players orchestrating these transformative initiatives. The future of energy is being reshaped, and the North Sea is at the heart of this evolution.

A Pan-European Commitment to CCUS:

The European CCUS sectors are witnessing unprecedented collaboration. Industry giants like Exxon Mobil, Shell, Wintershall, Total, and BP are joining forces, supported by government authorities. Dedicated project and subject matter teams, fortified with specialized expertise, are driving project planning and investment. Schlumberger, a leading player in North America, is actively planning 60 CCUS projects, even taking on the role of operator in several ventures.

Emphasizing Safety, Integrity, and Performance:

The energy industry’s commitment to Safety, Health, and Environmental (HSE) policies is unwavering. The focus on reducing leaks, enhancing well availability, minimizing unplanned maintenance, and cutting shut-in well costs is paramount. The result is improved production and performance of wells, reflecting a holistic approach to operational excellence.

Protecting Vital Assets from Corrosion:

In the upstream oil and gas environment, the battle against corrosion is relentless. Assets such as wells, risers, drilling rigs, offshore platforms, and pipeline connectors demand robust protection. The industry’s dedication to preserving these vital components underscores the importance of innovation and quality in ensuring long-term sustainability and efficiency.

This version maintains the technical focus while adding layers of context, engagement, and clarity. It emphasizes collaboration, innovation, commitment to safety, and the strategic importance of various initiatives within the energy sector, aiming to resonate with the target audience’s expertise and interests.

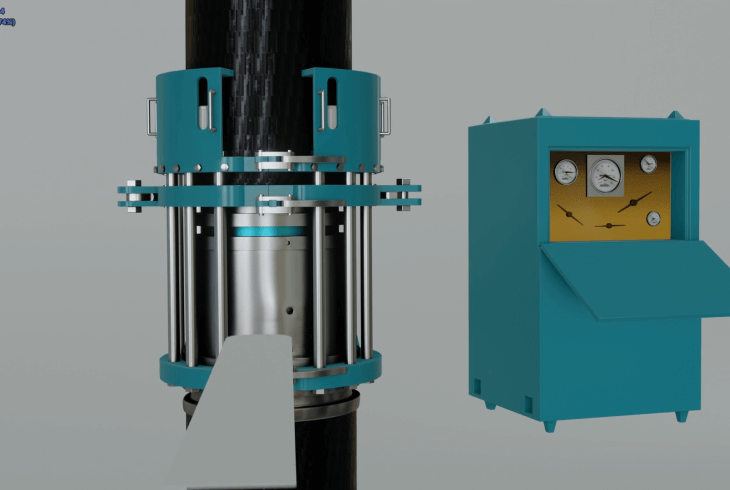

Introducing the CRA-Tubulars Product:

A Fusion of Innovation and Performance

1. Titanium Lined for Unmatched Durability:

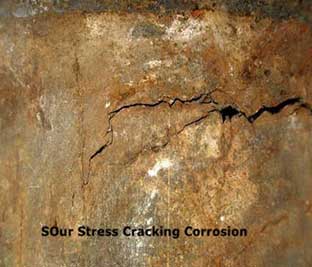

- Resistance to H2S and Chloride Induced SCC (Stress Cracking Corrosion): Our titanium-lined technology ensures immunity to common corrosive agents, setting a new standard in material integrity.

- Microcrack Prevention: The innovative liner design acts as a shield, preventing microcracks in the composite body, enhancing the lifespan and reliability of the product.

2. Premium Connections for Seamless Integration:

- API-5CT Compliant Traditional Sizes (ID/OD) Including Connections: Designed with industry standards in mind, our connections ensure compatibility and ease of integration.

- Off-the-Shelf Accessories, No Change to Operations: Our product is crafted for convenience, offering readily available accessories without altering existing operational procedures.

3. Carbon Fiber & Aerospace Grade Epoxy for Superior Performance:

- Lightweight Design (1/2 Weight of Metallic CRA): The fusion of carbon fiber and aerospace-grade epoxy results in a product that’s half the weight of metallic CRA, reducing completion stresses and forces.

- Optimized Temperature Coefficient (1/3 of Metallic CRA): Our technology’s temperature coefficient is a third of metallic CRA, further minimizing completion stresses and forces.

- Unparalleled Strength and Temperature Resistance: Matching and exceeding metallic CRA tubing with an impressive 18,000 PSI burst, 240,000 lbs tensile load, and a maximum operating temperature of 180°C (350°F), our product stands as a testament to innovation and quality.

The CRA-Tubulars Product: A Commitment to Excellence

At CRA-Tubulars, we believe in pushing the boundaries of what’s possible. Our product embodies this ethos, combining cutting-edge materials and engineering techniques to offer a solution that’s not just an alternative but a leap forward. Join us in embracing this transformative technology, designed for the challenges and opportunities of today’s energy landscape.

The Factory and Production Process

Titanium/Carbon Fiber and Advanced Aerospace Epoxy Resin

Market Volume

Understanding the Global Market: A Snapshot of Integrity Issues and Opportunities

1. The Scope of Well Integrity Challenges:

- Worldwide Impact: Across the globe, 812,000 wells grapple with integrity issues, a challenge that resonates across the energy sector.

- Permanent and Temporary Shutdowns: Approximately 9% of these wells are permanently shut-in, while 10% face temporary shutdowns, reflecting the magnitude of the problem.

2. The Dynamics of Drilling and Corrosion:

- Active Drilling Rigs: With around 2,000 active drilling rigs globally, and an average rig drilling a new well every 6-8 weeks, the annual tally reaches 14,000 newly drilled wells.

- The Corrosion Challenge: Of the 812,000 wells affected by corrosion, with an average well depth of 9,000 ft, the total market encompasses a staggering 6 million feet of pipe.

3. CRA-Tubulars: A Solution with Potential:

- Production Capability: One CRA-Tubulars production facility can produce approximately 800,000 ft of pipe per year, translating to an annual turnover of $90 million USD.

- A Step Towards a Cure: A single facility represents a solution for 0.025% of the corrosion-affected wells, a small but significant stride towards addressing a pervasive industry challenge.

CRA-Tubulars: A Vision for a Corrosion-Free Future

At CRA-Tubulars, we recognize the complexity and urgency of well integrity issues. Our technology is more than a product; it’s a vision for a future where corrosion is not a barrier but a challenge to overcome. With each foot of pipe produced, we are not just contributing to the market; we are shaping a path towards resilience, efficiency, and sustainability in the energy sector.

This version maintains the technical focus while adding layers of context, engagement, and clarity. It emphasizes the global challenges, market dynamics, and the strategic role of CRA-Tubulars in addressing well integrity issues, aiming to resonate with the target audience’s expertise and interests.

Pricing of TCT Compared with

Carbon Steel and Inconel

The Value Proposition of TCT: A Competitive Edge in Performance and Pricing

1. Pricing Dynamics of TCT:

- A Tailored Approach: The sales price of TCT (Titanium Composite Tubulars) is not a one-size-fits-all figure. It’s carefully calibrated to the field location, wellbore complexity, well depth, and other specific parameters, reflecting a nuanced understanding of diverse operational needs.

- Competitive Positioning: TCT tubing stands as a premium product, competitively priced on par with CR22 tubulars. But the comparison doesn’t end at the price tag.

2. TCT: Beyond a Price Tag, A Performance Benchmark:

- Outperforming Higher-Grade Pipes: What sets TCT apart is its ability to outperform even higher-grade pipes like Super Duplex and Inconel. It’s not just a product; it’s a promise of life-of-the-well service.

- A Budget Bargain with Uncompromised Quality: TCT’s competitive pricing, coupled with its superior performance, positions it as a budget bargain without sacrificing quality or reliability.

TCT by CRA-Tubulars: A Strategic Investment for the Future

At CRA-Tubulars, we believe that value is not merely a matter of cost but a balance of price, performance, and purpose. TCT embodies this philosophy, offering a solution that’s not just cost-effective but a strategic investment in quality and longevity. Join us in embracing TCT, a product designed for the challenges and opportunities of today’s energy landscape, where excellence is not a luxury but a standard.

Pricing of TCT | DUPLEX | INCONEL | TITANIUM COMPOSITE TUBING |

Lifetime of product in comparable corrosive environment | + | +++ | ++++++ |

Downtime due to shut-in well | ++++++ | ++ | + |

Minimum installation footprint | Rig | Rig | HWU |

Lead time for installation equipment | 6-12 Months | 6-12 Months | 2 Months |

Lead time of product | 6-12 Months | 12-18 Months | ± 2 Months |

Comparable Cost | $$$ | $$$$$$$ | 13CR < TCT < Duplex |

Way forward | Timeline & Milestones

- From idea to company 2010-2019.

- The company was founded in November 2019.

- vPrototype in Q1-2020 – 240K lbs, 18,000 PSI

- Proprietary connection final design stage.

- The CAL II testing (API-5CT/5C5) process is ongoing on GMC connector

- Sealock connector design & test planning on going.

- Currently in the final stage of trial negotiations.

- Targeting commercial operation in early 2024.

TCT Operational Advantages: Producer

TCT Operational Advantages: A Producer’s Perspective on a Superior Solution

1. The Global Challenge of Corrosion:

- A Costly Affair: Corrosion is more than a technical challenge; it’s an economic burden. The global cost of corrosion is staggering, estimated at US$2.5 trillion, equivalent to 3.4% of the global GDP in 2013, and this figure continues to grow annually. It’s a problem that demands a solution beyond mere mitigation.

2. Titanium Composite Tubing (TCT) A Breakthrough in Corrosion Management:

- Virtually Free of Corrosion: TCT leverages industry-standard titanium, crafting a solution that’s not just resistant but virtually free of corrosion. It’s a transformative approach that redefines the boundaries of material integrity.

- A Superior Alternative to Duplex or Nickel-Alloys: While traditional materials like Duplex or Nickel-alloys may delay corrosion, they don’t offer permanent solutions.

3. TCT: An Investment in Operational Excellence (OPEX):

- Beyond Cost Savings: TCT’s value transcends its competitive pricing. It’s an investment in operational excellence, where the absence of corrosion translates to enhanced reliability, efficiency, and sustainability.

- A Budget-Friendly Solution with Uncompromised Performance: TCT stands as a budget bargain without sacrificing quality or performance, positioning itself as a strategic choice for producers seeking long-term value.

Embracing TCT by CRA-Tubulars: A Vision for a Corrosion-Free Future

At CRA-Tubulars, we recognize that the battle against corrosion is not just about materials but a vision for a future where corrosion is not a barrier but a challenge overcome. TCT is our answer, a product designed with the precision, innovation, and quality that the energy sector demands. Join us in embracing this superior solution, where excellence is not an aspiration but a standard we live by.

Understanding OPEX:

The Impact of Workovers and the Promise of Titanium Composite Tubing (TCT)

1. The Financial Landscape of Oil and Gas Projects:

- Balancing Capex and OPEX: For any new oil and gas project, a meticulous calculation of costs is paramount. Operators must assess both up-front capital expenditure (capex) and expected ongoing operational expenditure (OPEX) over the life of the project. These figures are weighed against expected returns to determine the financial viability of the development. It’s a complex equation where every variable matters.

2. The Challenge of Workovers with Traditional Materials:

Duplex or Nickel-Alloys A Costly Cycle:

- Doubling the Well Cost: Every workover with these materials doubles the well cost, a financial burden that can’t be ignored.

- A Short Workover Cycle: With a 3-5 year workover cycle, the recurring costs and operational challenges add up, impacting the project’s long-term sustainability.

3. Titanium Composite Tubing (TCT) A Game-Changer in Workover Management:

- Workover with a Difference: TCT’s workover needs are limited to replacing accessories, and the tubing itself can be reused, a revolutionary approach that enhances efficiency and cost-effectiveness.

- A Long Workover Cycle: With a 20-year workover cycle, TCT stands as a long-term solution, not just a temporary fix. It’s a commitment to quality, reliability, and value over the life of the project.

TCT by CRA-Tubulars: A Strategic Choice for a Sustainable Future

At CRA-Tubulars, we believe that innovation is not just about creating products but shaping solutions that address real-world challenges. TCT embodies this philosophy, offering a response to the workover challenge that’s not just effective but transformative. It’s a choice that reflects foresight, strategic thinking, and a commitment to excellence. Join us in embracing TCT, where the future of workover management is not just promising but already here.

Understanding OPEX: The Impact of Workovers and the Promise of Titanium Composite Tubing (TCT)

1. The Financial Landscape of Oil and Gas Projects:

- Balancing Capex and OPEX: For any new oil and gas project, a meticulous calculation of costs is paramount. Operators must assess both up-front capital expenditure (capex) and expected ongoing operational expenditure (OPEX) over the life of the project. These figures are weighed against expected returns to determine the financial viability of the development. It’s a complex equation where every variable matters.

2. The Challenge of Workovers with Traditional Materials:

- Duplex or Nickel-Alloys A Costly Cycle:

- Doubling the Well Cost: Every workover with these materials doubles the well cost, a financial burden that can’t be ignored.

- A Short Workover Cycle: With a 3-5 year workover cycle, the recurring costs and operational challenges add up, impacting the project’s long-term sustainability.

3. Titanium Composite Tubing (TCT) A Game-Changer in Workover Management:

- Workover with a Difference: TCT’s workover needs are limited to replacing accessories, and the tubing itself can be reused, a revolutionary approach that enhances efficiency and cost-effectiveness.

- A Long Workover Cycle: With a 20-year workover cycle, TCT stands as a long-term solution, not just a temporary fix. It’s a commitment to quality, reliability, and value over the life of the project.

TCT by CRA-Tubulars: A Strategic Choice for a Sustainable Future

At CRA-Tubulars, we believe that innovation is not just about creating products but shaping solutions that address real-world challenges. TCT embodies this philosophy, offering a response to the workover challenge that’s not just effective but transformative. It’s a choice that reflects foresight, strategic thinking, and a commitment to excellence. Join us in embracing TCT, where the future of workover management is not just promising but already here.

OPEX and the Challenge of Chemical Inhibitor Programs:

A Comparative Analysis of Solutions

1. The Traditional Approach to Corrosive Wells:

- Premium Tubulars and Protective Coatings: Corrosive wells have traditionally necessitated the use of premium tubulars with protective chrome coatings on steel pipes. While this approach slows down the destructive nature of H2S and CO2, it’s not a cure.

- Chemical Regimes: A Temporary Fix: Often complemented by chemical regimes, this strategy merely delays the inevitable well failure due to corrosion. It’s a solution that addresses symptoms, not the underlying problem.

2. Duplex or Nickel-Alloys A Costly Path:

- Expensive Solutions with Short Lifecycles: While these materials offer a response to corrosion, they come with high costs and short lifecycles. They represent a financial burden without delivering long-term value.

3. Titanium Composite Tubing (TCT) A Revolution in Corrosion Management:

- Competitive Pricing: Priced below CR22 for one tubing, TCT offers a cost-effective alternative without compromising quality.

- A Long Workover Cycle with Significant Savings: With a 20-year workover cycle, TCT results in 62% lower CAPEX over the lifecycle. It’s not just a product; it’s a strategic investment in sustainability and efficiency.

TCT by CRA-Tubulars: A Vision for a Corrosion-Free Future

At CRA-Tubulars, we recognize that the battle against corrosion requires more than temporary fixes. It demands innovation, precision, and a commitment to long-term solutions. TCT is our answer to this challenge, a technology designed with the foresight, quality, and value that the energy sector needs. Join us in embracing TCT, where the future of corrosion management is not a distant dream but a present reality.

OPEX and the Challenge of Stress Corrosion Cracking:

A New Paradigm with Titanium Composite Tubing (TCT)

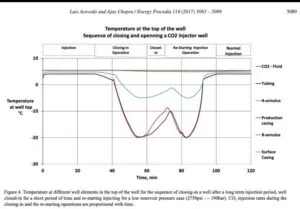

1. The Complex Dynamics of CCS and CO2 Injection Wells:

- Temperature Swings and Tension: Specifically in CCS (Carbon Capture and Storage) and CO2 injection wells, completions are subject to major temperature swings while in tension in the wellbore. This complex environment presents unique challenges.

- The Corrosive Challenge: The added corrosive nature of these wells can induce stress cracks in traditional steel tubulars, becoming the weak link in the completion. It’s a problem that demands more than a conventional solution.

2. Duplex or Nickel-Alloys A Limitation Exposed:

- Frequent Failures: High stresses from tubing weight and pressure frequently result in sour and chloride SCC (Stress Corrosion Cracking) failures with these materials. They may offer resistance, but their limitations are exposed under extreme conditions.

3. Titanium Composite Tubing (TCT) A Breakthrough in Stress Corrosion Management:

- Unmatched Resistance: TCT offers the highest resistance, even under the most extreme conditions, and maintains this performance even when conditions change over time. It’s a technology designed for resilience, adaptability, and longevity.

TCT by CRA-Tubulars: A Commitment to Excellence in Extreme Environments

At CRA-Tubulars, we understand that the energy sector’s challenges are not static but dynamic, evolving with the changing landscape of technology and demand. TCT is our response to the specific challenge of stress corrosion cracking, a product crafted with the precision, innovation, and quality that extreme conditions require. Join us in embracing TCT, where excellence is not a claim but a proven reality, tested and validated under the most demanding circumstances.

HSE and the Impact of Corrosion:

A Comparative Analysis of Safety Solutions

1. The Safety Challenge in the Upstream Oil and Gas Industry:

- A Disturbing Trend: The upstream oil and gas industry stands out with one of the highest rates of severe injuries compared to other large employment industries, according to an E&E News analysis of workplace injury data. By some measures, it ranks the highest. It’s a trend that cannot be ignored and demands immediate attention.

2. The Role of Corrosion in HSE Hazards:

- Workovers and H2S Accidents: With traditional materials like Duplex or Nickel-alloys, workovers become potential HSE hazards. The corrosive environment can lead to H2S accidents, which have fatal consequences. It’s a risk that calls for innovative solutions.

3. Titanium Composite Tubing (TCT) A Commitment to Safety:

- Reduced HSE Exposure: TCT offers a path to enhanced safety, reducing HSE exposure through its innovative design and material composition. It’s not just a product but a philosophy that prioritizes safety at every stage.

TCT by CRA-Tubulars: Safety as a Core Value

At CRA-Tubulars, we believe that safety is not just a regulatory requirement but a core value that defines our approach to technology and innovation. TCT embodies this commitment, offering a solution that addresses the specific HSE challenges posed by corrosion. Join us in embracing TCT, where safety is not a goal but a standard we uphold, a promise we make to our employees, our partners, and the industry we serve.

Frequently Asked Questions

We currently provide 2 3/8”, 2 7/8”, 3 ½’, 4 ½” and shortly in 5” tubing. These tubing sizes have standard API ID’s. Dimensions and tubing weight are as follows:

API Size: | OD Tubing | API Size: | ID | Weight | Thread Type |

Inch | mm | ID Inch | ID mm | LBS/ft | |

2.375″ | 60.325 | 1.995 | 49 | ~ 3.1 | any |

2.875″ | 73.025 | 2.244 | 57 | ~ 3.1 | any |

3.5″ | 88.9 | 2.795 | 71 | ~ 3.1 | any |

4.5″ | 114.3 | 3.724 | 94.6 | ~ 3.1 | any |

5″ | 127.0 | 4.408 | 111.96 | ~ 3.1 | any |

TCT is composed of a corrosion-resistant liner made of Titanium ASTM Grade-2. The liner is then covered with several layers of Aerospace grade carbon fiber and high-grade epoxy resin. The Ti. liner gives corrosion resistance and prevents permeation of any hydrocarbons into the CF layer. The CF layer provides strength in the axial and radial direction.

TCT is economical from a lifecycle cost perspective. It outlasts any high alloy metallic tubing. Considering the cost of several workovers, new tubing, chemical treatment, and cashflow impact resulting from shut-in periods, the price is very competitive. TCT is more economical than 13Cr tubing and certainly a lot less expensive than Duplex or Inconel tubing. TCT is priced slightly above CR13 tubing but will last many times longer.

CRA-Tubulars plans to manufacture tubing in-country or certainly within the region. In this model we expect to deliver Range 3 TCT tubulars in under 2 months, This is much faster than traditional jointed metal CRA completions. Delivery times of Duplex or Inconel are typically over 18 months.

TCT is provided in two grades: Burst and collapse 10KSI and the high grade >15KSI. Temperature is 180 degrees Celsius; this puts our non-metallic CRA comfortably in the HPHT range of applications. We have a high grade under development aiming to approach 200C.

No, to achieve the highest possible temperature resistance we are using highly crosslinked thus brittle resins. Our combination of resin, fiber, and the liner however is not brittle. Microcracks may occur in the outer layer over time – this is normal and does not affect its performance in any way.

Since TCT is as strong as metal, the behavior is expected to be similar. During such conditions steel tubing, drill pipe, and collars have been seen expelled from the well. That will likely happen with TCT too. Will it happen sooner? Not sure, but even if the event fully escalates 50% faster than with metal, the consequences will not be different, only instead of say an hour, it might happen in 30 minutes. Nothing to avert the consequence of such an event can be done in that time frame. Steel pipe, casing, and tubing have been sand-cut in minutes resulting from the extreme velocities of the two mediums together. Similar expectations for TCT.

There is no reason, when looking at other Industries, to believe non-metallic composite is less strong than metallic are. Airplanes are made of carbon fiber (CF), F1 cars are accident impact strengthened with CF. They are all much stronger than metal equivalent material. The unique and extreme forces in an uncontrolled well flow cannot be counteracted by metal or non-metallic composites, they will perform similarly.

Yes, there is sufficient safety on the collapse performance (radial hoop strength) to allow for safe installation and operation. Calculations have shown that with a tubing full of gas, zero pressure at surface, an annulus with packer fluid and max design pressure at surface (ie MDASP) there is no risk of collapse. Category: General Properties and Dimensions

In most of the corrosive well-operating environments, the expected life exceeds 20 to 30 years. Titanium is very durable, corrosion-resistant, and in other industries like seawater coolers in nuclear power plants and chemical industries, it is the metal of choice for high corrosion resistance.

Carbon fiber is strong and nearly inert to corrosion bar wet/temperature degradation over time. CRA-tubulars apply a safety factor to the operating envelope. The (initial) operating limits are the limits CF would have after degradation.

We use a propriety cross-over design from carbon-fiber composite to any metal CRA alloy matching any type of premium or non-premium thread required by the client.

As mentioned, we can provide any available thread type. TCT can be connected to any off-the-shelf completion accessory.

Our product can be provided as range 1, 2 or 3 tubing, similar to traditional OCTG. Tubing stress analysis indicates that well depths over 6,000 meters are still well within the operating envelope of the tubing.

TCT will in general be used in wells requiring a metal CRA tubing completion. However, the corrosive film on the Titanium liner is much harder than metal CRA alloy. Therefore, it will be much more difficult to damage that film contrary to Duplex or Inconel alloys. However, it is recommended to design and execute interventions similar to high Chrome, Nickel, or Inconel tubing. Carbon steel intervention tools can chip off steel splinters which could be embedded in the metal CRA tubing and give access to corrosion. If it is necessary to perform Interventions, non-metallic centralizers should be deployed, reduced running speed, especially in dry completions, like gas-wells. Intervention tools shall be selected new, burrs filed off. Plastic coated wire is a distinct advantage in both types of CRA tubing.

Not all cutting tools are advisable. Obviously, chemical cutters will not work, similarly, they do not work on metallic CRA tubing. The electric pipe cutting tool from Sondex wireline has been successfully tested on these materials.

Category: Intervention Activities

Yes, it can be milled but requires modified tools and reduced milling rates/conditions, bit type rpm, etc. The cuttings from milling the tubing are very light, and even lightweight, low viscosity brine will carry it to the surface.

Category: Intervention Activities

In the case of severed tubing, the fishing operation is similar to metal tubing. The TOF can be dressed, fished internally, or externally. A grapple overshot with slips engaging on the outside of the tubing and possibly a spear inside could work equally well as with traditional metal tubing fishing.

In the unlikely event that after a bit and scraper run the well is not fully accessible, the impact of TCT tubing weighing one-third of its metal competitor is low. Furthermore, TCT is as strong as metal, no issues.

Yes, TCT tubing can be made-up to any standard, any manufacturer’s accessory, as well as to nipples for plugs, standing valves, beam-pump seating nipples, etc. Any conventional completion design can incorporate TCT tubing.

At the moment this has not been tested, however, looking at a large number of available alternative options, mechanical or explosive, it should be possible.

Yes, a hydraulic control-line can be incorporated into the outer layer. Using available SCSSV’s and packer with integrated control-line options, it can be supplied. Similarly, fiber optic cable can be integrated. Existing technology allows for the cable to exit the tubing, bypass the accessory, and connect to the optic cable below again.

Power cable for ESP can be “wrapped” in the out layer, providing a sturdy and protected alternative to traditionally banding to the outside of the tubing.

Yes, there is sufficient safety on the collapse performance (radial hoop strength) to allow for safe installation and operation. Calculations have shown that with a tubing full of gas, zero pressure at surface, an annulus with packer fluid and max design pressure at surface (ie MDASP) there is no risk of collapse. Category: General Properties and Dimensions

In conventional metal CRA completion, monitoring of corrosion during the production life of the well is desired.

Can we inspect, and is that needed, in non-metallic CRA tubing?

Pulsed Eddy is a technology that could be tried on this new development. It makes non-magnetic elements slightly magnetic showing wall thickness reduction. It is a proven technology in measuring riser wall thickness and airplane structure inspection.

Downhole Video is a visual option to investigate the condition of the inside of the tubing.

CRA tubulars intends to further develop this requirement for those clients needing to comply with this requirement.

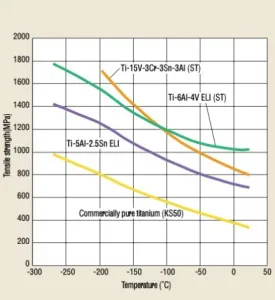

Carbon Capture and Storage requires captured CO2 to be pumped as a liquid down old oil and gas wells. Pumping the liquid CO2 into an empty reservoir below hydrostatic pressures a well would allow the liquid to “evaporate” at the top of the well, resulting in a large temperature drop. This Joule Thompson cooling effect varies with the effective remaining reservoir pressure. Over time this evaporation will reduce as reservoir pressure increases. TCT is designed with two unique components suited for this purpose, Titanium-Ti and Carbon Fiber-CF. Titanium has a track record as a storage vessel for liquid Helium and CF was used on NASA’s Space Shuttle liquid Oxygen and Hydrogen tanks. These proven track records in extreme cold environments, exhibit fit for purpose application of TCT components. Kobe steel puts the minimum temperature limit of Titanium at minus -269 degrees Celsius (4 degrees Kelvin). Carbon fiber in the grade used in TCT can safely be applied to minus -40 degrees Celsius without losing its strength.

In comparison, (metallic-CRA-alloys) like Duplex or Super Duplex are limited at around minus -50 C and minus -100 degrees C respectively.

Additionally, prices of these (metallic-CRA-alloys) are much higher than TCT, making it a very interesting economical alternative in these applications.

The thermal resistance of carbon fiber (through-thickness) =0.8W/m-K.

The TCT total thermal resistance per length (1 meter) R=0.0339K/W

Carbon fiber has a negative Coefficient of Thermal Expansion (CTE) and since it is so much stiffer than the surrounding epoxy, the combined effect is dominated by the CF. Therefore, the Temperature Coefficient is between 1/3 and 1/2 of that of metal tubing.

This number will be derived from that of Titanium and carbon fiber and gives a thermal pipe resistance of R=0.0339K/W per unit length of 1 meter.

Titanium on its own is used for Helium storage vessels because of its extreme low-temperature capabilities. Carbon fiber on its own was used on the Space Shuttle liquid Oxygen and Hydrogen tanks. Both applications are low-temperature environments. The difference in the operating envelope in CCS wells and the aforementioned applications are the forces and stresses experienced in wells. However, Titanium shows an increase in tensile strength when cooled down (Source Kobe Steel).

Low Temperature Characteristics

Neither commercially pure titanium nor titanium alloys become brittle even at extremely low temperatures. In particular, commercially pure titanium and Ti-5AI-2.5Sn ELI can be used even at 4.2 K (-269°C)

Carbon fiber has a negative Coefficient of Temperature Expansion (CTE), reducing thermal effects and forces resulting from temperature fluctuations. Our resin used in TCT can safely be exposed to minus -40 degrees Celsius. As can be seen from this temperature profile simulation illustrated, it would make TCT perfectly suitable for the large majority of CCS wells. It will only go below minus -20C in exceptional cases. At a price around 13Cr tubing, the Operator will get superior service to duplex or Inconel properties, low-temperature coefficient, and low tubing weight.

Carbon Capture and Storage requires captured CO2 to be pumped as a liquid down old oil and gas wells. Pumping the liquid CO2 into an empty reservoir below hydrostatic pressures a well would allow the liquid to “evaporate” at the top of the well, resulting in a large temperature drop. This Joule Thompson cooling effect varies with the effective remaining reservoir pressure. Over time this evaporation will reduce as reservoir

pressure increases. TCT is designed with two unique components suited for this purpose, Titanium-Ti and Carbon Fiber-CF. Titanium has a track record as a storage vessel for liquid Helium and CF was used on NASA’s Space Shuttle liquid Oxygen and Hydrogen tanks. These proven track records in extreme cold environments, exhibit fit for purpose application of TCT components. Kobe steel puts the minimum temperature limit of Titanium at minus -269 degrees Celsius (4 degrees Kelvin). Carbon fiber in the grade used in TCT can safely be applied to minus -40 degrees Celsius without losing its strength.

In comparison, (metallic-CRA-alloys) like Duplex or Super Duplex are limited at around minus -50 C and minus -100 degrees C respectively.

Additionally, prices of these (metallic-CRA-alloys) are much higher than TCT, making it a very interesting economical alternative in these applications.

The thermal resistance of carbon fiber (through-thickness) =0.8W/m-K.

The TCT total thermal resistance per length (1 meter) R=0.0339K/W

Carbon fiber has a negative Coefficient of Thermal Expansion (CTE) and since it is so much stiffer than the surrounding epoxy, the combined effect is dominated by the CF. Therefore, the Temperature Coefficient is between 1/3 and 1/2 of that of metal tubing.

INTRODUCING THE TEAM

150+ Years experience in delivering shareholder returns

EMILE BURNABY LAUTIER

Founder

JOOST DE BAKKER

CEO

REIN MAATJES

CTO

RODERICK VAN SEVENTER

CFO

FLORIS DEGENER

Well Engineer

FRED NILSON

CCO

HARMEN KLEIN WOOLTHUIS

Equipment Engineer

JEROEN VAN BUSSEL

Composites Specialist

ARJAN LOK -LLM

Legal Councel

KEVIN COX -PhD

Head Of DesignTechnical Partners

Commercial Partners

Contact Us

Feel free to get in touch with us

Write Us

Commercial Matters

FRED NILSON

+1 (661) 472-0581

Commercial Matters

JOOST DE BAKKER

Technical Matters

REIN MAATJES